All Categories

Featured

There is no one-size-fits-all when it comes to life insurance. Getting your life insurance plan appropriate thinks about a variety of aspects. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your busy life, financial independence can seem like an impossible objective. And retired life might not be top of mind, because it seems so much away.

Pension, social safety and security, and whatever they 'd handled to conserve. It's not that very easy today. Less employers are using traditional pension and many companies have lowered or terminated their retired life strategies and your capacity to rely entirely on social protection remains in concern. Also if advantages have not been decreased by the time you retire, social safety and security alone was never ever planned to be enough to pay for the way of life you want and deserve.

/ wp-end-tag > As part of a sound monetary method, an indexed universal life insurance coverage plan can help

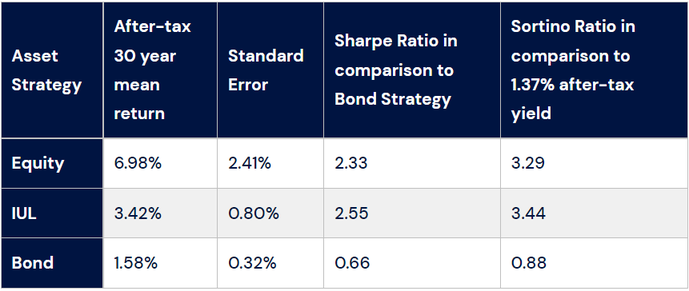

you take on whatever the future brings. Before devoting to indexed global life insurance policy, right here are some pros and disadvantages to consider. If you pick an excellent indexed universal life insurance plan, you may see your money value expand in value.

Iul Retirement

Considering that indexed universal life insurance coverage requires a certain degree of danger, insurance coverage firms tend to maintain 6. This kind of strategy additionally provides.

Commonly, the insurance policy business has a vested passion in executing far better than the index11. These are all factors to be thought about when choosing the finest type of life insurance coverage for you.

Max Funded Indexed Universal Life Insurance

However, considering that this sort of plan is extra complex and has an investment component, it can commonly come with greater premiums than various other plans like entire life or term life insurance policy. If you do not believe indexed global life insurance policy is appropriate for you, here are some choices to take into consideration: Term life insurance policy is a short-lived policy that normally provides coverage for 10 to three decades.

When choosing whether indexed universal life insurance policy is right for you, it is essential to consider all your choices. Entire life insurance may be a far better choice if you are searching for even more security and consistency. On the various other hand, term life insurance coverage may be a better fit if you just require coverage for a certain period of time. Indexed universal life insurance coverage is a kind of plan that provides much more control and adaptability, in addition to higher cash money value development possibility. While we do not supply indexed universal life insurance coverage, we can supply you with even more details concerning whole and term life insurance plans. We suggest exploring all your options and talking with an Aflac representative to find the most effective suitable for you and your family members.

The rest is added to the cash worth of the plan after costs are deducted. While IUL insurance policy may show useful to some, it's vital to comprehend how it functions prior to purchasing a plan.

Latest Posts

Index Insurance Definition

Linked Life Insurance

Difference Between Whole Life Vs Universal Life